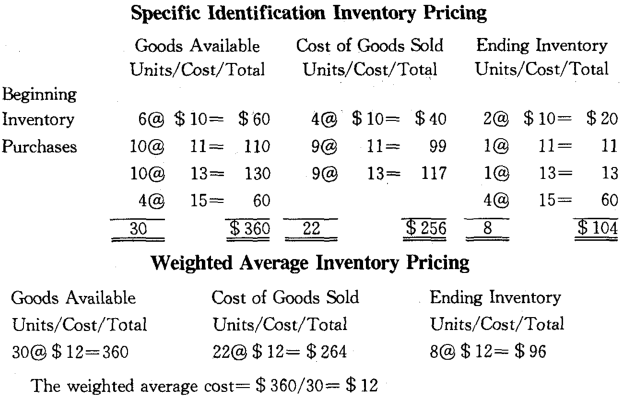

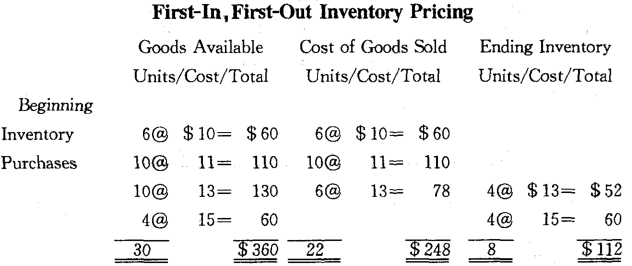

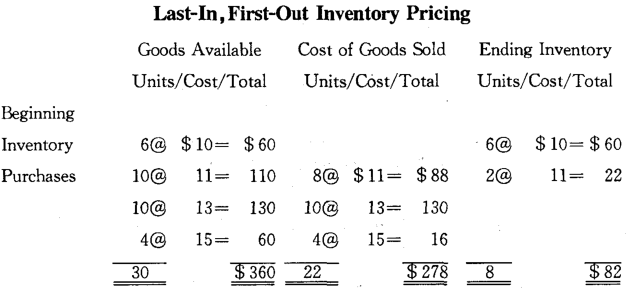

Proper income determination depends on the appropriate measurement of all assets; the higher the asset amounts, the higher the income that will be reported. Because inventories are often relatively large and their size fluctuates, it is important to account correctly for inventories if net income is to be determined properly. "Taking” an inventory consists of (1) counting the items involved, (2) pricing each item, and (3) summing the amounts. In general, inventories are priced at their cost. Inventory pricing is quite simple when acquisition prices remain constant. When prices for like items change during the accounting period, however, it is not always apparent which price should be used to measure the ending inventory. We shall introduce four generally acceptable methods of pricing inventories:

- specific identification;

- weighted average;

- first-in, first-out;

- last-in, first-out.

The specific identification approach to inventory most naturally fits operations that involve somewhat differentiated products of a relatively high unit value. New automobiles and construction equipment are good examples. Specific identification is not feasiblewhere products are of a low unit value and involve large volumes.

The weighted average approach to inventory measurement is best suited to operations that involve a large volume of undifferentiated goods stored in common areas. The weighted average cost represents to some degree all the various costs experienced in accumulating the goods currently on hand. Consequently, weighted average costs typically fall between the extreme cost figures that can result from other methods.

Most companies-especially those with perishable or style affected goods-as a matter of good business attempt to sell the oldest merchandise first. In these cases, FIFO most nearly matches the flow of costs to the probable flow of goods.

Although LIFO presents the least plausible flow of goods for most businesses, it is used only in U. S. A. by many major firms. When prices are rising, LIFO results in lower reported income and thus may provide a related tax benefit. LIFO bettermatches current costs against current revenues because the most recent purchases are reflected as cost of goods sold. However, it consequently prices the ending inventory at the older, less realistic unit price. Because of this, the LIFO inventory figure on the balance sheet often becomes quite meaningless in terms of current cost prices.

The illustrations mentioned above are those under the periodic inventory system.

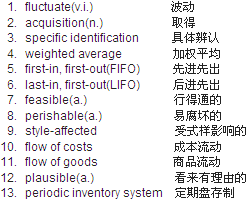

New Words, Phrases and Special Terms

Notes to the Text

1. Proper income determination depends on the appropriate measurement of all assets; the higher the asset amounts, the higher the income that will be reported.

(1)用分号“;”把两个在意义上有联系的句子连在一起。

(2)分号后面的一句是用 thehigher…the higher…连接的比较句型,对比的是the asset amounts 和 the income that will be reported.

(3)that引导的定语从句用来修饰the income.

2. When prices for like items change during the accounting period, however, it is not always apparent which price should be used to measure the ending inventory.

(1)全句包含一个用连词when引导的时间状语从句。

(2)主句中,引词it是形式主语,从句which price…是真正主语。which 是连接形容词。

3. Specific identification is not feasible where products are of a low unit value and involve large volumes.

(1)全句包含一个用连词where引导的地点(场合)状语从句。

(2)从句内,连词and连接两个并列的谓语:are of a low unit value和involve large volumes.

READING MATERIAL

ESTIMATING INVENTORIES

When interim financial statements are prepared, it may be impractical to take physical inventorycounts(实物盘点). An estimate will be sufficient. The gross profit method of estimating inventories (估计存货的毛利法)is usually employed.

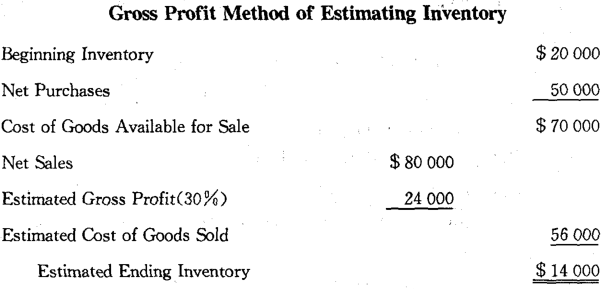

Suppose that over the past three years a company’s gross profit averaged 30% of net sales. Assume also that the net sales for the interim period are $ 80 000,the inventory at the beginning of the period was $ 20 000, and net purchases for the period are $ 50 000. The following exhibit shows the analysis that can be made to estimate the ending inventory.

This type of analysis is merely a rearrangement of the cost of goods sold section of the income statement. For the gross profit method to be valid, the gross profit percentage must be representative of the merchandising activities leading up to the time when the inventory is estimated.

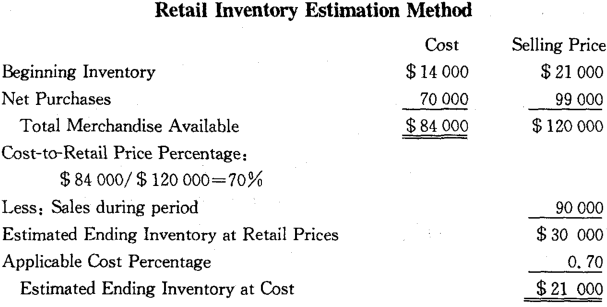

The second approach to estimating inventories is widely used by retailbusinesses(零售商店),such as department stores(百货商店),that are likely to keep periodic inventory records. Such firms typically mark each item of merchandise with the retailprice(零售价格)and record purchases at both cost and retail price. A firm can estimate its ending inventory at retail price merely by subtracting sales from the retail price of merchandise available for sale. To determine the inventory cost, the firm will apply a cost-to- retail price percentage(成本对零售价比率). This percentage is the ratio of cost to retail price of merchandise available. In the following exhibit, this ratio is 70%,which, when applied to the $30 000 retail value of the inventory, yields a cost amount of $ 21 000.

The cost-to-retail price ratio can also be used to compute the cost of an actual physical inventory taken at retail prices. Thus, the firm saves the considerable effort and expense of determining individual cost prices for each item of the inventory.

The accuracy of the retail inventory method depends on the assumption that the ending inventory contains the same proportion of goods at the various mark-up(标价) percentages as did the original group of merchandise available for sale. To the extent that the mix(品种构成)of mark-up percentages does not remain constant, the accuracy of the estimate is impaired.