Wages and salaries represent a major element in the cost structure of most businesses. The precise nature of an enterpriser’s payroll records and procedures depends to a great extent on the size of its work force and the degree to which the recordkeeping is automated. In some form, however, two records are basic to most payroll systems: the payroll register and individual employee earnings records.

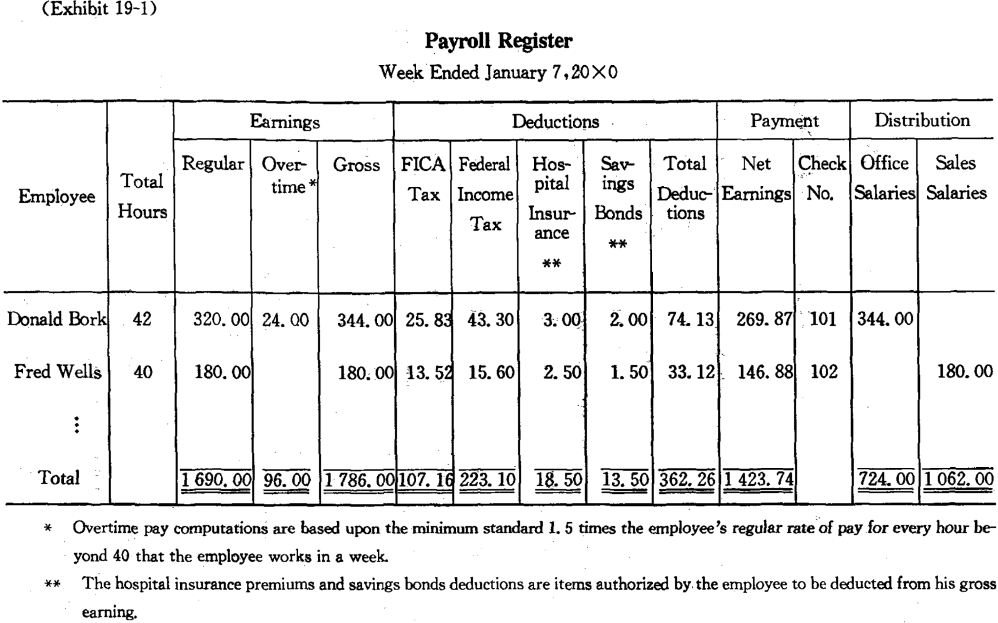

The payroll register is a detailed listing prepared each pay period of the company’s complete payroll. Each employee’s earnings and deductions for the period are contained in the payroll register. Exhibit 19-1 illustrates a payroll register typical of those prepared by a firm with a small number of employees.

Payroll accounting procedures are influenced significantly by legislation enacted by the U. S. federal and state governments. These laws affect payroll accounting because they levy taxes based on payroll amounts.

(1) The Federal Insurance Contributions Act establishes the tax levied on both employee and employer. FICA tax applies to wages paid to employees during a calendar year, up to a certain amount per employee. Let us suppose that the tax was applied to the first $ 45 000 of an employee’s wages and the tax rate is planned by legislation as 7. 51%.

(2) Employers are required to withhold federal income taxes (and state income taxes in most states) from wages and salaries paid to employees. The amount of income tax withheld from each employee is based on the amount of the employee’s wage or salary, the employee’s marital status, and the number of withholding allowances to which the employee is entitled. Employers usually use wage-bracket tables prepared by the government to determine the amount of federal income taxes to withhold from each employee. Figures in our illustration are supposed to be based on such wage-bracket tables.

The payroll register often serves as the basis for an entry to record the weekly payroll in the general journal. In our illustration, the entry would be:

Office Salaries Expense 724. 00

Sales Salaries Expense 1 062. 00

FICA Tax Payable 107. 16

Federal Income Tax Withholding Payable 223. 10

Hospital Insurance Premiums Payable 18. 50

Savings Bonds Deductions Payable 13. 50

Payroll Payable 1 423. 74

(3) Besides the FICA tax,which is levied on both employee and employer, the FUTA(Federal Unemployment Tax Act) tax is levied only on the employer. Suppose that the law established the rate at 5. 6% of the first $ 7 000 paid to each employee, but the employer is entitled to a credit against this tax for the state unemployment compensation taxes. The maximum credit allowed is 4. 3% of the first $ 7 000 of each employee’s wages. Hence, the effective FUTA rate on the employer will generally be 1. 3% of the first $ 7 000 paid to each employee. The entry to record the employ’s payroll tax liabilities for the week would be:

Payroll Tax Expense 218. 07

FICA Tax payable (7. 51%×$1 786) 134. 13

Federal unemployment Tax Payable

(1.3%×$ 1 786) 23.22

state Unemployment Tax Payable

(4.3%×$1 786) 60.72

The various liabilities established in the entries recording the payroll and the employer’s payroll taxes are settled by the employer making payments to the appropriate parties. The legislation levying various taxes also specifies the procedures for remitting these taxes to the government and establishes the reports an employer must file.

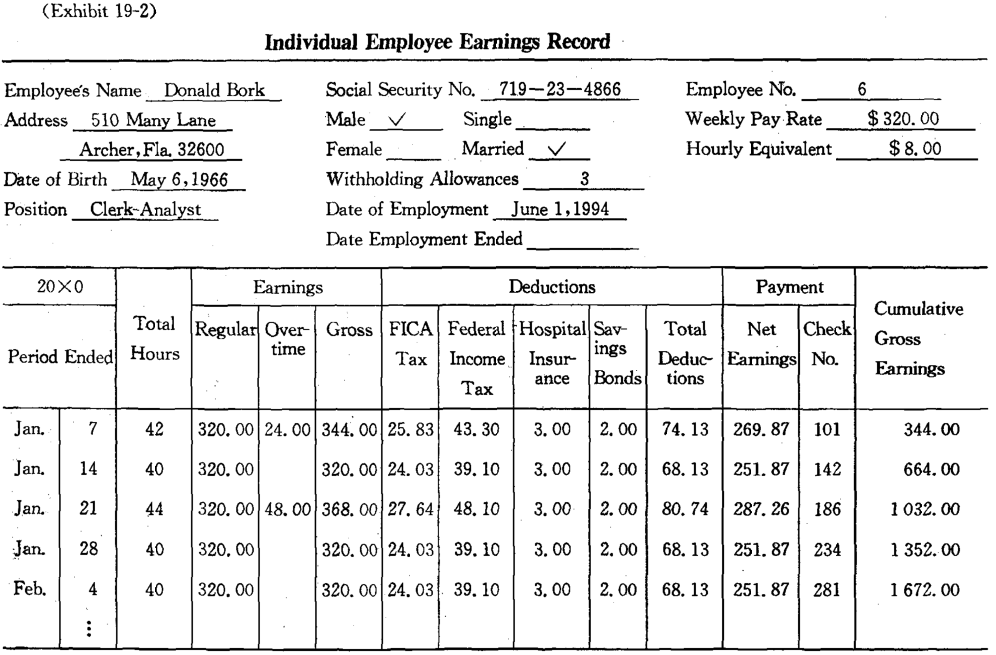

While a payroll register lists information on the gross earnings and deductions of all employees for each payroll period, the individual employee earnings records contain information on gross earnings and deductions for each employee for all payroll periods during the year. This record contains much of the information needed to permit the employer to comply with the various taxation and reporting requirements established by law. Its last column headed "Cumulative Gross Earnings” enables the employer to know when an employee’s earnings for the year have exceeded the maximum amounts to which the FICA and unemployment taxes are applied.

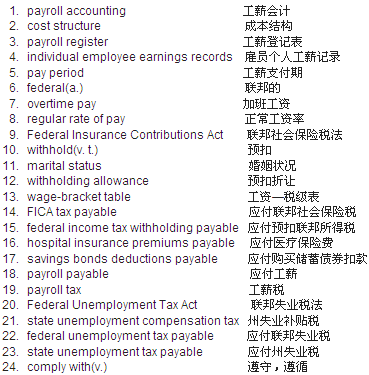

New Words, phrases and Special Terms

Notes to the Text

1. The precise nature of an enterprise's payroll records and procedures depends to a great extent on the size of its work force and the degree to which the recordkeeping is automated.

(1)动词depend后要接用介词on(或upon)。句中,插在depends和on 之间的介词短语to a great extent是修饰谓语动词depends的状语。

(2)在depends on的两个并列的宾语(用and连接)the size…和the degree to which…中,定语从句to which…修饰the degree。

2. The legislation levying various taxes also specifies the procedures for remitting these taxes to the government and establishes the reports an employer must file.

(1)现在分词短语levying various taxes 修饰句中主语the legislation。

(2)连词and连接两个并列的谓语also specifies…和establishes…。

(3)在前一段谓语中,介词短语for…修饰谓语动词specifies的宾语the procedures。这一介词短语的宾语是动名词短语remitting…government 。

(4)在后一段谓语中,定语从句an employer must file修饰谓语动词establishes的宾语the reports。引导这一定语从句的关系代词that,用作从句中谓语动词must file的宾语,被省略。3. Its last column, headed “Cumulative Gross Earnings” enables the employer to know when an employee’s earnings for the year have exceeded the maximum amounts to which the FICA and unemployment taxes are applied.

(1)headed "Cumulative Gross Earnings"是全句主语its last column 的同位语。

(2)全句谓语动词enables的复合宾语the employer to know…中,补语是一个不定式复杂结构。

(3)在这个不定式复杂结构中,不定式to know的宾语是用连接副词when引导的从句。

(4)在这一宾语从句中,又包含一个修饰the maximum amounts的定语从句(用关系代词which引导)。

READING MATERIAL

PAYMENT TO EMPLOYEES

A company with small number of employees may pay them with checks drawn on the firm’s regular bank account. With a large number of employees, it is usually more practical to establish a separate bank account to pay the payroll.

When a company uses a separate payroll bank account,each pay period it draws a check on its regular bank account in an amount equal to the total net earnings of the employees. This check is deposited in the payroll bank account. Individual payroll checks are then drawn on this account and delivered to the employees. The issuance of the payroll checks reduces to zero the book balance in the payroll bank account.

One advantage of maintaining a separate payroll bank account is that it readily permits a division of work between the preparation and issuance of regular company checks and payroll checks. A related advantage is that it simplifies the monthly reconciliation of the regular bank account. The large number of payroll checks, many of which may be outstanding(未兑付的)at month-end, are not run through the regular bank account. Of course,the payroll bank account also needs to be reconciled, but typically, the only reconciling item for this bank account will be payroll checks outstanding.

Sometimes employees are paid in currency and coin rather than by check This may happen, for example, if the employees work in a location where it may not be convenient for them to deposit or cash(兑现)checks. The company will prepare and cash one of its own checks for the payroll amount. Each employee’s pay is put into a pay envelope (工薪袋)and delivered to the employee. As a feature of internal control and to have evidence of the payment made,an employee should sign a receipt for the payroll envelope.