Corporations’ earnings are accumulated separately from its paid-in equity capital. Some of the major transactions related to retained earnings are:

(1)Cash dividends, which reduce retained earnings and become a current liability when declared.

The following entry would be made at the declaration date:

Retained Earnings XXX

Dividends Payable-Preferred Stock XXX

Dividends Payable-Common Stock XXX

On the payment date, the following entry would be made in the cash disbursements journal :

Dividends Payable-Preferred Stock XXX

Dividends Payable-Common Stock XXX

Cash XXX

Some companies, especially those paying quarterly dividends, debit an account called Dividends Declared at the time of declaration. Until closing, this account is classified as a contra account to Retained Earnings. At the end of each year, the Dividends Declared account is closed by a debit to Retained Earnings.

(2) Stock dividends, which represent a transfer of retained earnings to the appropriate stock and paid-in capital accounts.

For small stock dividends (additional shares issued are fewer than 20% of the number previously outstanding) the AICPA recommends transferring an amount equal to the market value of the shares issued from Retained Earnings to stock and paid-in capital accounts.

Assume that before declaration of a 10% stock dividend there are 2 000 shares of $ 50 par value common stock outstanding and the shares are being sold at a market price of $ 70 per share. The amount to be transferred from Retained Earnings would be $ 14 000 (200 shares),of which $ 10 000 (par value of the shares) is credited to the account Stock Dividend to Be Issued and the premium of $ 20 per share, or $4 000,is credited to Paid-in Capital in Excess of Par Value.

Retained Earnings 14 000

Stock Dividend to Be Issued 10 000

Paid-in Capital in Excess of Par Value 4 000

When the stock is distributed, the following entry is made:

Stock Dividend to Be Issued 10 000

Common Stock 10 000

If a balance sheet is prepared between the date that a stock dividend is declared and the date it is distributed, the account Stock Dividend to Be Issued is shown as a separate item and is added to the account Common Stock.

When the number of shares issued as a stock dividend is large enough to reduce materially per-share market value, the amount transferred from Retained Earnings to stock account is the minimum required by the law (that is, the legal capital). Usually this amount is the par or stated value of the stock.

(3) Appropriations, which are actually segregations of retained earnings.

The appropriated amount will reduce the retained earnings available for dividends. For example, assume that the board of directors has appropriated $ 10 000 for plant expansion. The following entry may be made:

Retained Earnings 10 000

Retained Earnings Appropriated

for Plant Expansion 10 000

When the purpose is accomplished or the event transpires for which the appropriation was made, the restricted amount is returned, intact, to inappropriate retained earnings.

(4)Corrections of material errors made in previous periods.

These corrections will be charged or credited directly to Retained Earnings account.

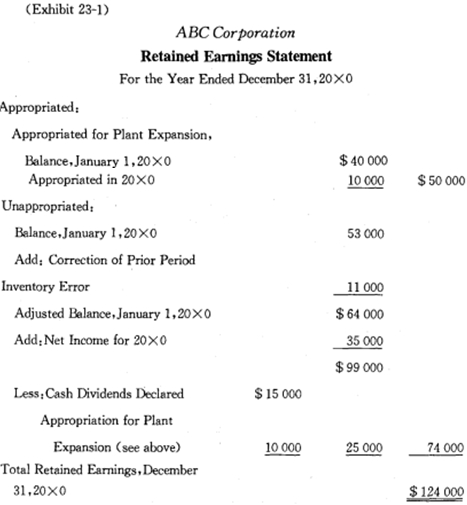

A retained earnings statement is usually presented with the other corporate financial statements. It is an analysis of the retained earnings accounts (both appropriated and unappropriated) for the accounting period. The form of this statement is not standardized, and sometimes it is combined with the income statement An example of a retained earnings statement is shown below:

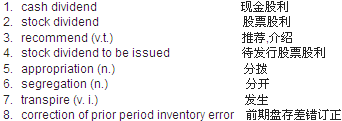

New Words, Phrases and Special Terms

Notes to the Text

1. Cash dividends, which reduce retained earnings and become a current

liability when declared.

(1)cash dividends作为本段的标题,用一个定语从句修饰它。

(2)定语从句中还包含一个用连词when引导的时间状况从句:when (they are) declared.

2. If a balance sheet is prepared between the date that a stock dividend is declared and the date it is distributed, the account Stock Dividend to Be Issued is shown as a separate item and is added to the account Common Stock.

(1)全句包含一个用连词if引导的条件状语从句。

(2)在这一状语从句中,还包含两个用连词that引导的同位语从句,作为两个the date的同位语,第二个同位语从句中的连词(that)被省略。

3. When the purpose is accomplished or the event transpires for which the appropriation was made, the restricted amount is returned, intact, to inappropriate retained earnings.

(1)全句包含一个用连词when引导的时间状语从句。

(2)这一从句是由or连接的两个并列分句the purpose is accomplished 和the event transpires 组成。

(3)在后一段的分句中,还包含一个修饰分句主语the event的定语从句,关系代词which在从句中作介词for的宾语。

READING MATERIAL

EARNINGS PER SHARE

Financial statistics of great interest to corporation shareholders and potential investors are the earnings per share of common stock (普通股每股收益额).A single presentation of earnings per share is appropriate for corporations with a simple capital structure (简单资本结构), which contains no securities that, if exercised or converted, would reduce (dilute 稀释,摊薄)earnings per share of common stock. Corporations with complex capital structure (复杂资本结构),which contains one or more potentially dilutive securities, present data on both primary earnings per share (每股原先收益额)and fully diluted earnings per share (每股完全稀释收益额).Convertible debt (可转换债券), convertible preferred stock(可转换优先股), stock options(股票期权)and stock warrants (认股权)are examples of potentially dilutive securities, because if they are exercised or converted, the number of outstanding shares of common stock increases.

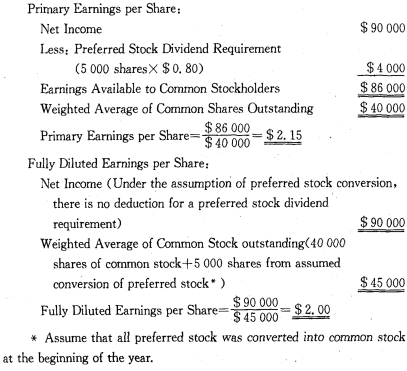

To illustrate the computation of primary and full diluted earnings per share, let us suppose the Minor Corporation had a net income of $ 90 000 for the current year. All year, the corporation had 40 000 shares of common stock and 5 000 shares of convertible preferred stock outstanding. The annual dividend on the convertible preferred stock is $ 0. 80 per share and each share is convertible into one share of common stock.

The form in which earnings-per-share data are disclosed should correspond with the nature of the income statement content. Thus, if a firm has reported extraordinary gains and losses, an earnings-per-share amount should be disclosed for income before extraordinary items as well as for net income. Similar disclosures should be made if the income statement contains an adjustment for the cumulative effect of a change in accounting principle.