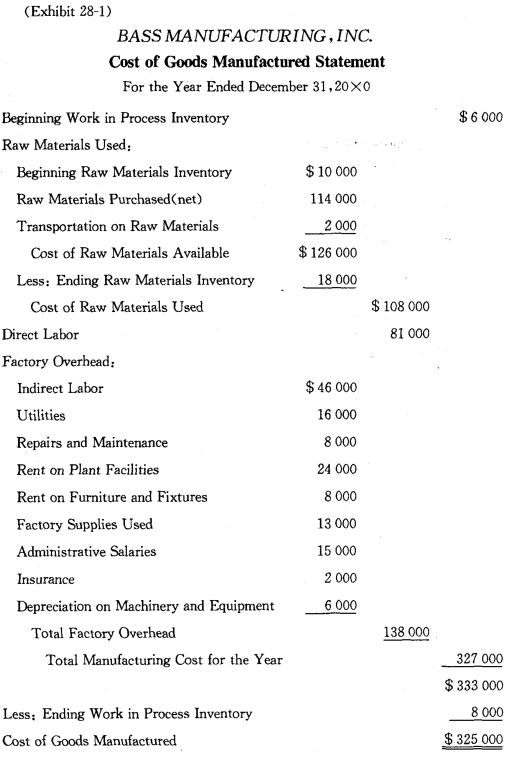

The primary difference between merchandising and manufacturing firms is that merchandising firms buy finished products to sell while manufacturers make the products they sell. Manufacturing costs are accounted for in three categories:(1) raw materials, (2) direct labor, and (3) factory overhead, or manufacturing overhead (all other manufacturing costs not included in raw materials and direct labor, sometimes called factory burden). A cost of goods manufactured statement is given in Exhibit 28-1.

Exhibit 28-1 shows that the cost of goods manufactured equals the total of all manufacturing costs for the period adjusted for the change in work in process inventory. Manufacturers have three inventory accounts—Raw Materials, Work in Process, and Finished Goods. In manufacturing accounting, all product costs—raw materials, direct labor, and factory overhead—are capitalized; that is, they become the cost of goods manufactured and represent additions to the asset finished goods inventory.

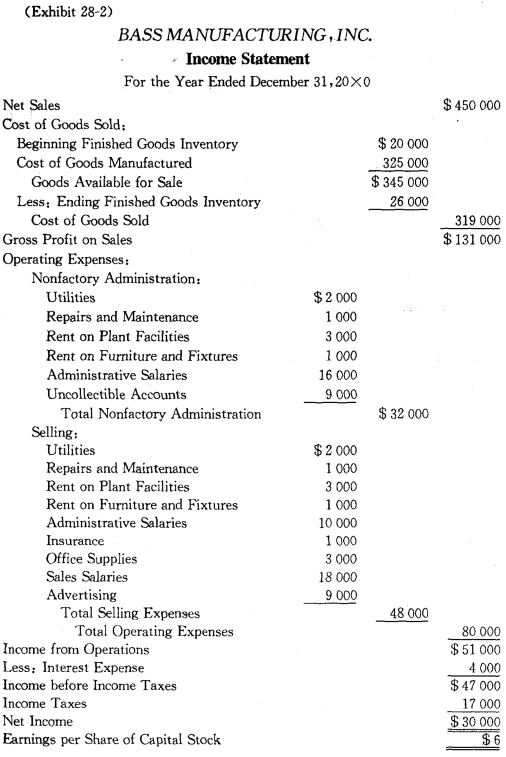

The income statement of a manufacturing firm appears in Exhibit 28-2.

Notice that:

(1)Cost of goods sold equals cost of goods manufactured adjusted for the change in finished goods inventory.

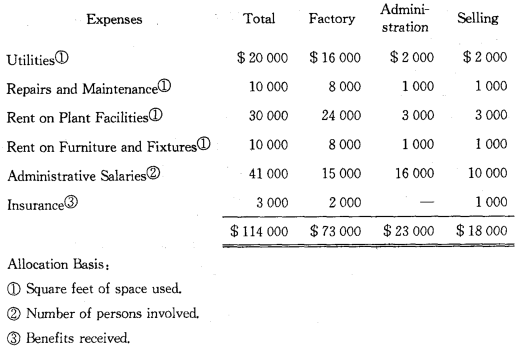

(2)The totals of certain expenses are allocated in production, selling, and non-factory administration on some rational basis (such as number of persons involved or square feet of space used). Our illustration assumes the following allocations:

The Work in Process Inventory account reflects the costs of products that have been begun but are not completed at the end of the accounting period. In a general accounting system using periodic inventory procedures, the amount of work in process is estimated at the end of the period, usually by a production supervisor or someone else familiar with the manufacturing process. However, most manufacturing firms employ a cost accounting system which provides timely unit product costs through the use of perpetual inventory procedures and predetermined factory overhead rates.

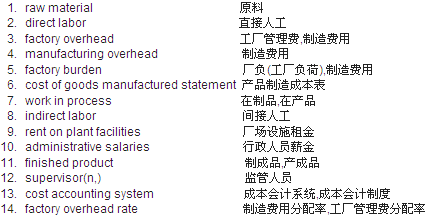

New Words, Phrases and Special Terms

Notes to the Text

The primary difference between merchandising and manufacturing firms is that merchandising firms buy finished products to sell while manufacturers make the products they sell.

(1)全句的表语是用连词that引导的从句。

(2)这一从句由连词while连接的两个并列的分句构成。

(3)在后一个分句中还包含一个用来修饰the product的定语从句they sell.关系代词that在定语从句中作谓语动词sell的宾语,可省略。

READING MATERIAL

END-OF-PERIOD PROCEDURES FOR A MANUFACTURING FIRM

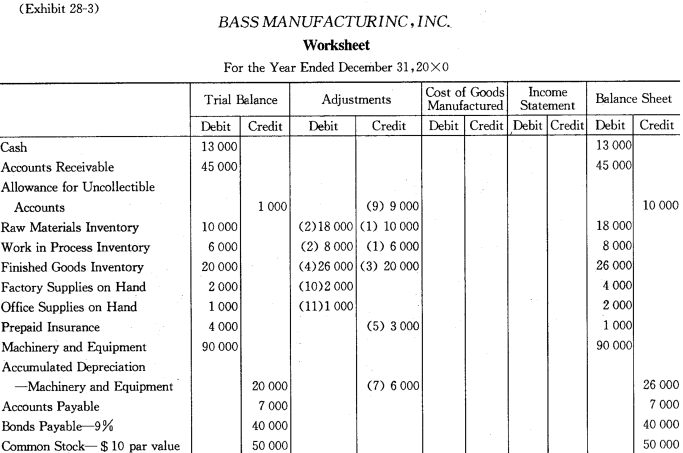

Most end-of-period procedures for manufacturing firms using periodic inventory system are similar to those for merchandising and service firms. Worksheets for manufacturing firms (see Exhibit 28-3) have an additional set of columns for the cost of goods manufactured. In addition to an Income Summary account, a Manufacturing Summary (制造成本汇总)account is needed in adjusting and closing procedures.

The adjustments on the worksheet are keyed to the parenthetical numbers of general journal entries below. When annual statements are prepared, adjusting entries are recorded in the general journal and posted to general ledger accounts.

1. Beginning inventories of raw materials and work in process:

Manufacturing Summary 16 000

Raw Materials Inventory 10 000

Work in Process Inventory 6 000

2. Ending inventories of raw materials and work in process:

Raw Materials Inventory 18 000

Work in Process Inventory 8 000

Manufacturing Summary 26 000

(3)Beginning inventory of finished goods:

Income Summary 20 000

Finished Goods Inventory 20 000

(4)Ending inventory of finished goods:

Finished Goods Inventory 26 000

Income Summary 26 000

(5)Unexpired Insurance:

Insurance Expense 3 000

Prepaid Insurance 3 000

(6)Accrued wages and salaries unpaid at year-end (direct labor $4 000,indirect labor $3 000,administrative salaries $1 000, and sales salaries $ 2 000):

Direct Labor 4 000

Indirect Labor 3 000

Administrative Salaries Expense 1 000

Sales Salaries Expense 2 000

Wages and Salaries Payable 10 000

(7)Annual depreciation on machinery and equipment,$ 6 000:

Depreciation Expense-Machinery and Equip 6 000

Accumulated Depreciation-Machinery and Equip 6 000

(8)Accrued interest payable at year-end,$ 1 000:

Interest Expense 1 000

Interest Payable 1 000

(9)Uncollectible accounts expense estimated at 2% of sales:

Uncollectible Accounts Expense 9 000

Allowance for Uncollectible Accounts 9 000

*(10) Factory supplies on hand, $ 4 000:

Factory Supplies on Hand 2 000

Factory Supplies Used 2 000

*(11) Office supplies on hand, $2 000:

Office Supplies on Hand 1 000

Office Supplies Used 1 000

(12) Estimated income taxes, $ 17 000:

Income Tax Expense 17 000

Income Tax Payable 17 000

* Bass Manufacturing, Inc. charged supplies cost to expense accounts when purchased.

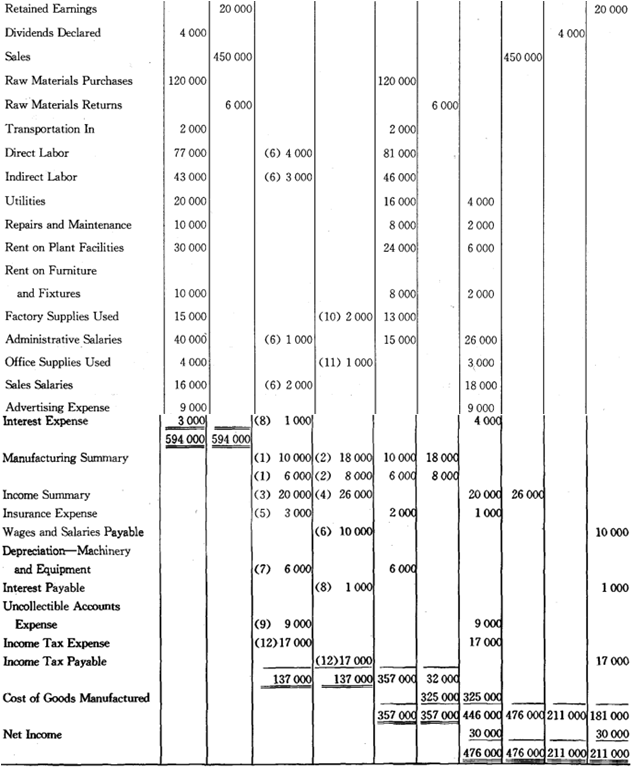

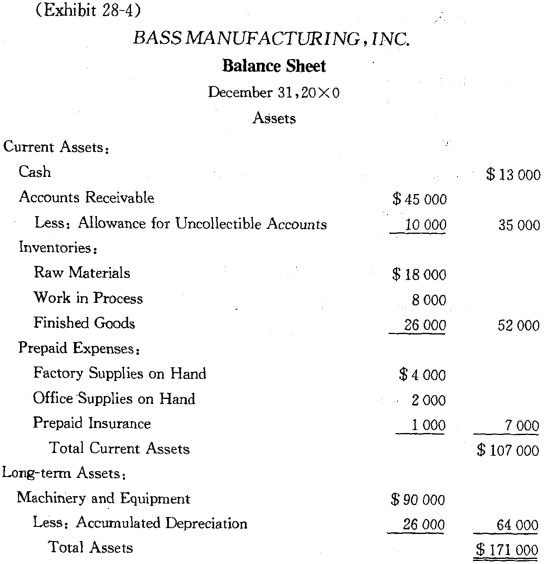

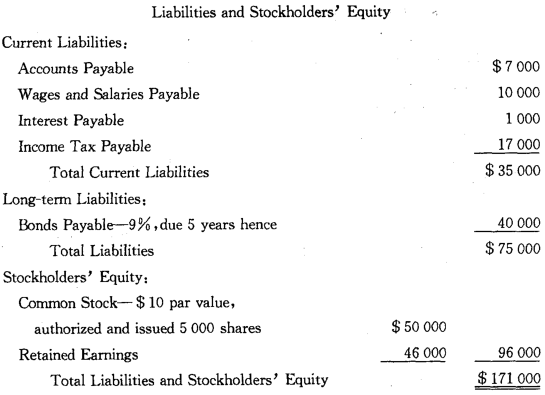

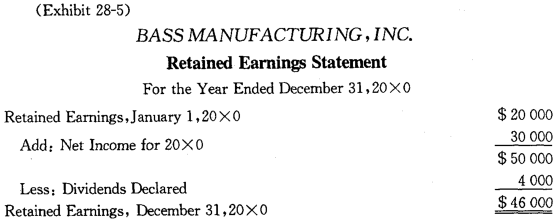

When properly completed, the worksheet contains all the data necessary to prepare the financial statements. The Cost of Goods Manufactured Statement and the Income Statement have been presented in the text. Here, we show the Balance Sheet and the Retained Earnings Statement (in Exhibits 28-4 and 28-5).

Following are the closing entries:

(a) To close the temporary manufacturing accounts:

Manufacturing Summary 341 000

Raw Materials Purchases 120 000

Transportation In 2 000

Direct Labor 81 000

Indirect Labor 46 000

Utilities Expense 16 000

Repairs and Maintenance 8 000

Rent on Plant Facilities 24 000

Rent on Furniture and Fixtures 8 000

Factory Supplies Used 13 000

Administrative Salaries 15 000

Insurance Expense 2 000

Depreciation Expense-Machinery and Equipment 6 000

Raw Materials Returns 6 000

Manufacturing Summary 6 000

(b)To close all expense accounts and the Manufacturing Summary account:

Income Summary 426 000

Utilities Expense 4 000

Repair and Maintenance 2 000

Rent on Plant Facilities 6 000

Rent on Furniture and Fixtures 2 000

Administrative Salaries 26 000

Office Supplies Used 3 000

Sales Salaries 18 000

Advertising 9 000

Interest Expense 4 000

Insurance Expense 1 000

Uncollectible Accounts Expense 9 000

Income Tax Expense 17 000

Manufacturing Summary 325 000

(c)To close Sales account:

Sales 450 000

Income Summary 450 000

(d)To close the Income Summary and Dividends Declared accounts:

Income Summary 300 000

Retained Earnings 300 000

Retained Earnings 4 000

Dividends Declared 4 000

Bass Manufacturing Inc. classified Dividends Declared as a contra account to Retained Earnings until closing.

After the closing entries are recorded and posted, a post-closing trial balance may be taken. Reversing entries are usually made for the accruals at the beginning of the subsequent year.