There are two basic types of cost accounting systems: job order cost accounting and process cost accounting. Job order cost accounting (sometimes called job lot or specific order costing) is appropriate when production is characterized by a discontinuous series of products or jobs undertaken either to fill specific orders from customers or for a general stock of products from which future orders will be filled. This type of costing is widely used in construction, printing, and machine shop operations. Often the products or batches of product vary in their material components and manner of production. In contrast, process cost accounting lends itself most readily to the production of a large volume of undifferentiated products manufactured in a "continuous flow” operation, such as distillation of fuels or the manufacture of paint, chemicals, wire and similar items. Essentially the same ingredients and operations are involved during each period of manufacture. A major purpose of either system is to allocate manufacturing costs to products to determine unit costs.

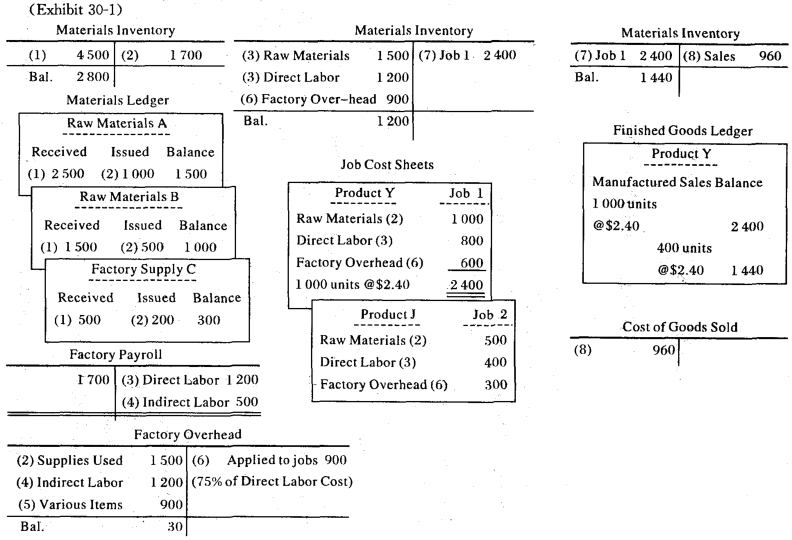

A simplified illustration of job order cost accounting is diagramed in Exhibit 30-1.

In a job order costing system, costs are identified with the specific jobs or orders to determine the cost of products manufactured. Job cost sheets will serve as the subsidiary records for the Work in Process account. Detailed material inventory records and requisitions must differentiate between raw materials and factory supplies and accumulate the cost of raw materials by job number. Likewise, detailed payroll records and time tickets must differentiate among direct labor, indirect labor, non-factory labor costs and accumulate direct labor costs by job number. Factory supplies used and indirect labor costs are accumulated in Factory Overhead account together with all other manufacturing expenses. As explained earlier, actual overhead is not identified directly with specific jobs. Instead, through the use of a predetermined overhead rate (here,75% of direct labor cost),the Work in Process account is charged with estimated overhead absorbed ($ 1 200X75%= $900), which is $ 30 less than the actual overhead incurred ( $ 930) in our illustration.

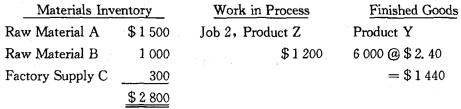

After overhead cost has been entered on the job cost sheets, all elements of cost—raw materials, direct labor and overhead—can be totaled. When a job order is completed, the unit cost is obtained by dividing the number of units produced into the total accumulated cost. The job cost sheet can then be removed from the Work in Process ledger and filed. At the same time, an entry is made in the Finished Goods ledger, showing quantities, unit cost, and total cost of the product entered. At the end of the accounting period, when all related postings to general ledger accounts are completed, the materials ledger cards, job cost sheets, and finished goods ledger should present a detailed analysis of the balances in the Materials, Work in Process, and Finished Goods accounts, respectively:

New Words, Phrases and Special Terms

Notes to the Text

1. Job order cost accounting (sometimes called job lot or specific order costing) is appropriate when production is characterized by a discontinuous series of products or jobs undertaken either to fill specific orders from customers or for a general stock of products from which future orders will be filled.

(1)全句包含一个用连词when引导的时间状语从句。

(2)在这一状语从句内,用以修饰jobs的过去分词复杂结构undertaken…中,用either…or…连接两个并列的状语,一个是不定式短语to fill…,一个是由介词for引导的复杂结构,其中的定语从句from which…用来修饰a general stock of products。

2. In contrast, process cost accounting lends itself most readily to the production of a large volume of undifferentiated products manufactured in a “continuous flow” operation, such as distillation of fuels or the manufacture of paint, chemicals, wire and similar items.

(1)这是一个简单句,句内包含许多短语。

(2)In contrast是在整段文句中承上启下的插入语。

(3)短语动词lends itself…to中,lend后要接用介词to。

(4)这一短语动词的宾语是the production of a large volume of undifferentiated products,并且用一个过去分词短语manufactured…作为定语来修饰它,在这一短语中,such as distillation…or the manufacture…是a "continuous flow" operation 的同位语。

READING MATERIAL

VARIABLE, FIXED, SEMIVARIABLE COSTS

For purposes of analyzing their behavior patterns (性态模式),factory costs are usually classified as variable(变动的),fixed (固定的)and semi-variable (半变动的). The classification of factory costs into these distinct groups is seldom a simple matter. however. Costs frequently behave in an erratic and inconsistent manner and the cost analyst must be quite circumspect(慎重) in analyzing their behavior.

Variable costs are those costs that change proportionately with changes in the volume of activity. Raw (or direct) materials cost, for example, usually behaves in this manner. Direct labor cost can also often be classified as variable.

Fixed costs (sometimes called non-variable costs不变成本)are those that are usually related to a time period and remain unchanged when the volume of activity changes. Examples are depreciation on buildings and property taxes.

Semi-variable costs are sometimes called mixed costs (混合成本) because they can be described analytically as having both fixed and variable components. A semi-variable cost is one that increases or decreases(线性地)with changes in activity, but is also some positive amount at zero activity. Changes in total semi-variable costs are therefore not proportional to changes in operating volume.

As an example of a semi-variable cost, consider a firm’s utility expense. Even if the firm were to shut down production(停产)for one period, it would be required to pay a minimum amount for utilities. When production resumed, the cost of heat, light, and power would increase as production increased. Total production costs, in fact, are virtually always semi-variable.

Per-unit costs behave as follows when volume of activity is increased:

Variable—remains constant,

Fixed—decreases proportionately,

Semi-variable—decreases less than proportionately.