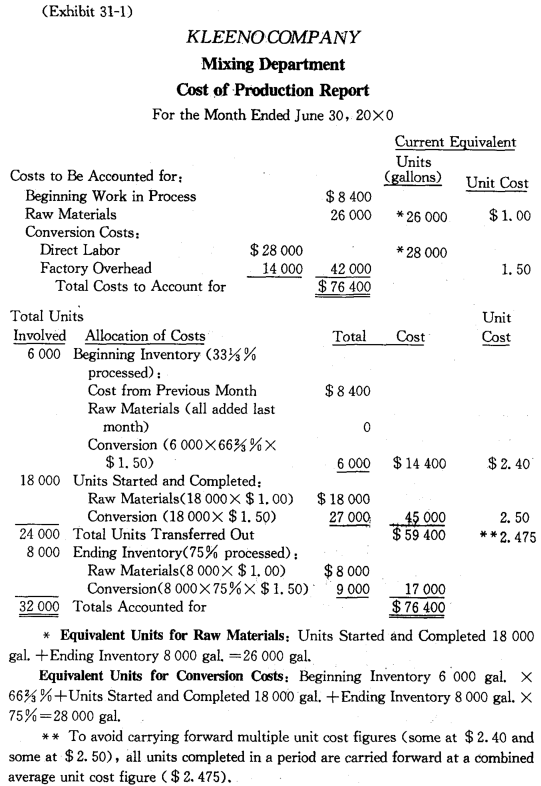

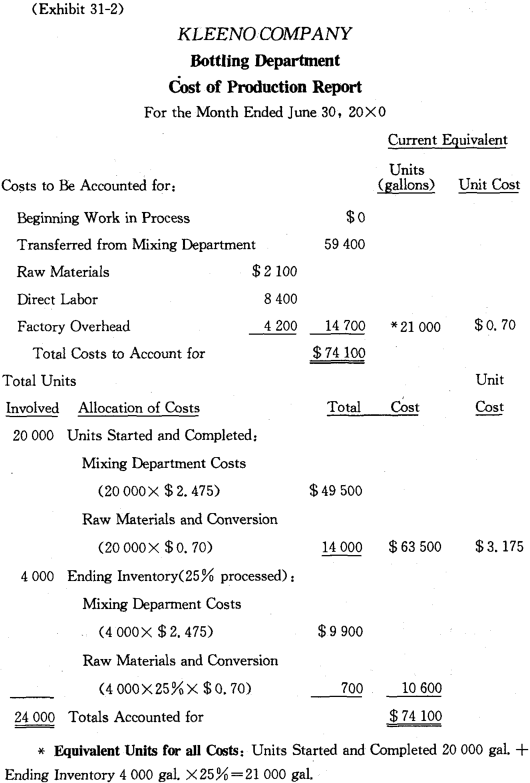

In Lesson Thirty, we explained that a process cost system is appropriate in accounting for costs in the production of a large volume of relatively homogeneous products manufactured in a "continuous flow” operation. Costs in a process costing system are identified with a cost center (a processing or production department) during a period of time—usually a month. A separate work-in-process account is kept for each processing or production department, and monthly costs are accumulated in these accounts. At the end of each month, costs are summarized for each cost center in a cost of production report. This report provides the unit cost information that can be used to determine costs of goods transferred from process to process and finally into the finished goods inventory. Thus, whereas a job order system has one work-in-process account supported by a number of job cost sheets; a process system has several work-in-process accounts, each supported by a monthly cost of production report. In a sense, process cost accounting is basically an averaging computation. It results in averaging the total process costs for a time period over the related amount of production accomplished during that period. The following cost of production reports illustrate the cost computing procedures for a liquid product, the production of which involves only two successive processes mixing and bottling. In Mixing Department, various ingredients are added at the start of the process and conversion costs are incurred evenly throughout processing. In Bottling Department, both raw materials and conversion costs are assumed to occur evenly throughout the process. The company uses a predetermined overhead rate of 50% of direct labor costs in both departments.

Note that:

(1)When there is ending work-in-process inventory, the measurement of work accomplished in a period requires that partially completed units be converted to a smaller number of equivalent units. If materials are added and conversion accomplished at different rates (or unevenly), equivalent units must be computed separately for each cost factor (as in the case of mixing department).

(2)The total of all costs in beginning inventories and all costs charged to work in process must be accounted for as cost of ending work-in-process plus cost of goods transferred out

(3)In assigning manufacturing costs, it is helpful to think of three batches of products: units transferred out from beginning work-in-process inventories, units both begun and completed this period, and units remaining in ending work-in-process inventories.

(4)The total cost to be accounted for in a department includes any cost associated with units transferred in from another department.

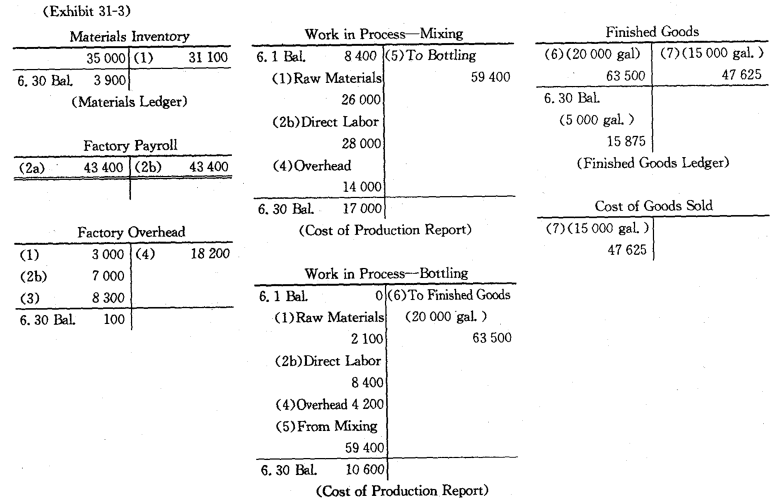

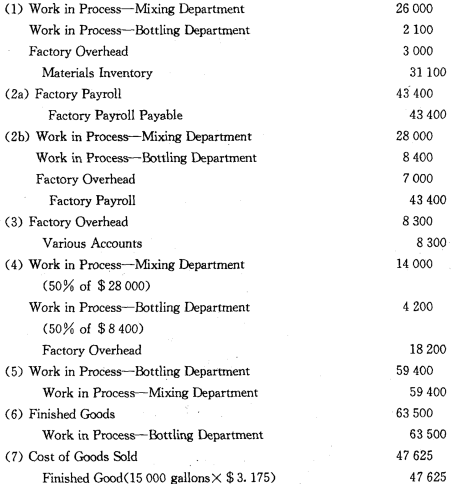

The flows of manufacturing costs and the related summary entries may be presented as follows:

New Words, Phrases and Special Terms

Notes to the Text

1. Thus, whereas a job order system has one work-in-process account supported by a number of job cost sheets ; a process system has several work-in-process accounts, each supported by a monthly cost of production report.

(1)用whereas连接的并列句。

(2)在后一段分句aprocess system has…中,包含一个由代词each+过去分词短语supported by…组成的独立结构。

2. When there is ending work-in-process inventory, the measurement of work accomplished in a period requires that partially completed units be converted to a smaller number of equivalent units.

(1)全句包含一个用连词when引导的时间状语从句。

(2)主句中谓语动词requires的宾语是由连词that引导的从句,从句中 的谓语动词be converted属祈使语气。

READING MATERIAL

COST ALLOCATIONS FOR JOINT PRODUCTS AND BY-PRODUCTS

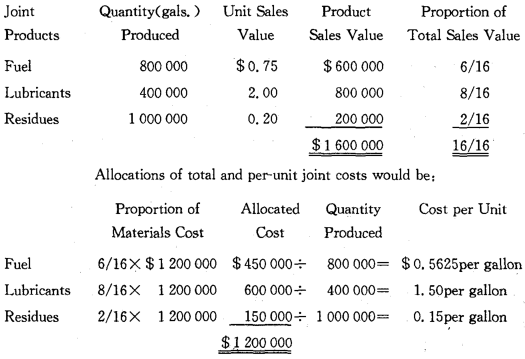

Joint products (联产品) are products of significant value originating from a common raw material or process. An obvious example of a raw material whose processing results in joint products is crude oil, from which a wide variety of fuels, solvents, lubricants, and residual petrochemical pitches are derived. Joint product costs are allocated among joint products primarily for purposes of inventory costing. Probably the most popular method of allocating joint costs is the relative sales value method(对比售价法). The total joint cost is allocated to the several joint products in the proportions that their individual sales values bear to the total sales value of all joint products at the split-off point (where physical separation is possible). For example, assume that 50 000 32-gallon barrels of crude oil costing $ 1 200 000 will be processed into 800 000 gallons of fuel selling for $ 0.75 a gallon, 400 000 gallons of lubricants selling for $ 2 a gallon and 1000 000 gallons of petrochemical residues selling for $ 0.20 per gallon. The following calculations illustrate how this joint cost would be allocated using the relative sales value method.

By-products (副产品) are products that have relatively little sales value compared with the other products derived from a process. By-products are considered incidental to the manufacture of the more important products. For example, the sawdust or shavings generated in a lumber planing mill (刨木工场)is a by-product. The appropriate accounting procedure for byproducts is to assign them an amount of cost equal to their sales value less any disposal costs. The net amount is charged to an inventory account for the by-product and credited to the work-in-process account to which the original materials were charged.